The lockdown due to the Covid-19 outbreak has caused the global financial crisis. To inject liquidity in the economy, the FM minister announced the Stimulus package India 2020 in five tranches. The 20 lakh crore stimulus package of India is as much as 10% of GDP. The package did not leave any major sphere untouched but failed to stir the market emotion. This article gives an overview of the stimulus package and explains why it failed to impress the stock market.

What is stimulus package & purpose?

The stimulus package as the name suggests is a package of incentives and tax relaxations to protect the economy from financial crisis and recession. The purpose of the stimulus package is to save the economy from the irrecoverable losses.

This cycle continues till the economy recovers from the collapse. In India, the stimulus package was introduced in the year 2008. It was during the time of the global recession to ensure the safety of bank deposits and the stability of the financial system.

Expectations of the package

The stimulus package was expected to be in line with the Narendra Modi’s vision of Atmanirbhar (self-reliant) India. It is 10% of the GDP which is 20 lakh crore. It is in line with what other countries would have announced during this period. The economic measures have addressed the problems of the most affected sections of the society like migrant workers. The common expectations from the package were:

- The manufacturing sector needs an urgent infusion of nearly $200 billion to kick start the market and retrieve the business cycle without further economic losses. The Indian industry cannot sustain further economic damage if adequate financial support was not provided.

- The government should work on an inclusive growth package that addresses the problem of unemployment.

- The problems are going to sustain for the small businesses and MSMEs for the upcoming three quarters. They are turning to government support in the form of working capital to rebuild the business and retain the workforce.

- The prime focus of the government is on the infrastructure sector. PM addressed infrastructure as one of the five pillars of the strategy of self-reliant India.

Thus, an inclusive growth stimulus package was expected to address the issues of the majority of the sectors and boosts overall economic revival.

Stimulus Package Highlights

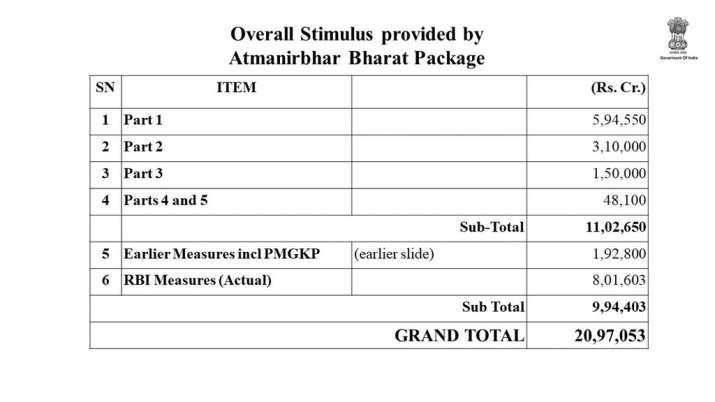

The stimulus package India was announced in five tranches. The Breakup of 20 lakh crore package is as follows:

First Tranche

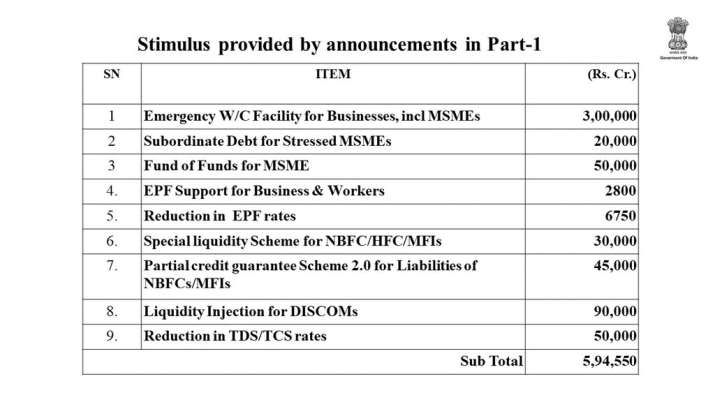

The first tranche of Stimulus Package India included funding and collateral-free loans and it focused on small businesses, non-bank lenders, distribution companies, and salaried workers. The major highlights were:

- The government will provide collateral-free loans of Rs. 3 lakh crores for MSMEs which will enable 45 lakh units to restart work and save jobs.

- Rs 30,000 crore special liquidity scheme is introduced for investing in investment-grade debt paper of NBFCs, HFCs, and MFIs. The funding in MSMEs will be guaranteed by the government of India.

- The liquidity relief of Rs. 2500 crore EPF support will be paid by the government to all the organizations for the next three months. The decrease in statutory EPF contribution will decrease from 12% to 10% which will infuse Rs.6750 crore liquidity in all the organizations.

- The power distribution companies will get Rs. 90000 crore liquidity against receivables from state-owned Power Finance Corp. and Rural Electrification Corp.

Second Tranche

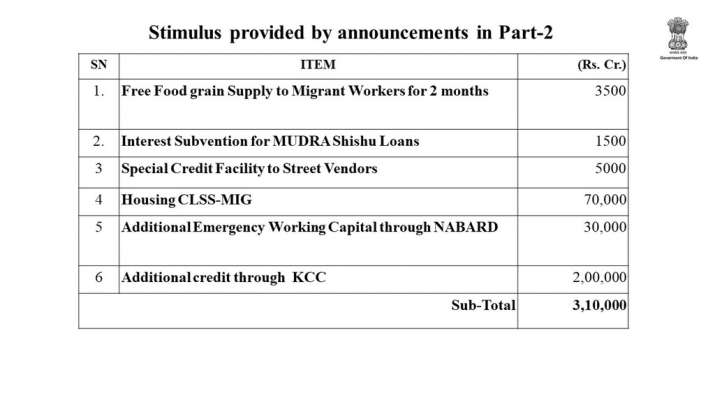

The second tranche of the Stimulus Package India focused on 5 prime categories:

Migrant workers

- The government will provide free food grain supply to migrant workers for 2 months.

- One Nation One Ration Card will give free access to all fair price shops to all workers in India by March 2021 by the use of technology systems.

- The government will launch a scheme under PMAY (Pradhan Mantri Awas Yojana) for migrant labor/urban poor to provide ease of living at an affordable rent.

Small farmers

- The emergency working capital fund of Rs 30000 crore will help around 3 crore farmers to meet post-harvest (Rabi) and Kharif requirements.

Street Vendors

- The street vendors can avail the working capital of up to Rs.10000 under the special scheme announced by the government. It will inject liquidity of approximately Rs. 5000 crores.

Small business owners

- The lockdown has affected the small businesses income and their capacity to pay. The RBI has already granted the loan moratorium and now the government will provide interest subvention of 2% for prompt payees for 12 months. It has allocated 1500 crores interest subvention for MUDRA-Shishu loans.

Self-employed

- The government has provided Rs. 70000 crore boost to the housing sector and middle-income group through the extension of CLSS (Credit Linked Subsidy Scheme) to increase demand for construction materials and create more employment opportunities.

Third Tranche

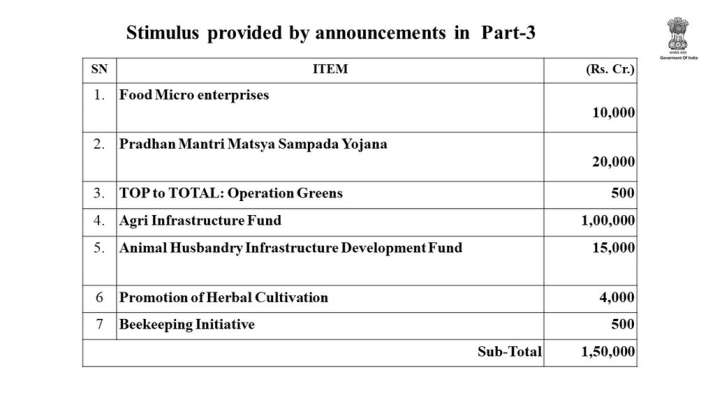

The third tranche of Stimulus Package India focused on steps for farmers and agricultural and food processing sectors. The major highlights were:

- The government has decided to allocate one lakh crore fund for developing strong farm gate infrastructure like cold chains, post-harvest storage infrastructures, etc.

- There will be a focus on making amendments in the Essential Commodities Act for making better price realization for farmers.

- The government will form a central law to provide adequate marketing choices, barrier-free interstate trade, and a framework for e-trading of agricultural produce.

- A facilitative legal framework for farmers to interact with sellers and traders in a fair and transparent manner. The purpose is risk mitigation and quality standardization of agricultural products.

Fourth Tranche

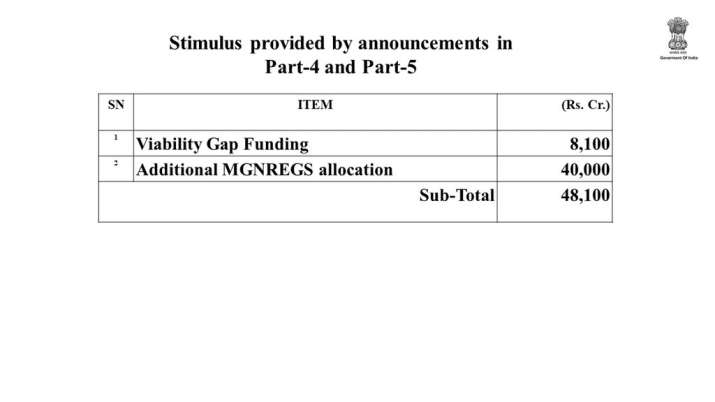

The fourth tranche focused on structural reforms in 8 different critical sectors: Coal, Minerals Defence Production, Airspace management, Social Infrastructure Projects, Power distribution companies, Space sectors, and Atomic Energy. Thus, the four tranche revolved around the injection of liquidity in the power & distribution companies.

Fifth Tranche

The fifth tranche focused on the structural reforms in the sector such as:

- Additional 40000 crore funding to the Mahatma Gandhi National Rural Employment Guarantee Scheme

- All the districts will have infectious disease hospitals and public health labs will be set up at the block level.

- PM eVidya program will be launched to enable one TV channel for Standard 1 to Standard 12. Also, the top 100 universities will be permitted to launch online courses from May 30, 2020.

- There were changes in IBC reforms as well as Decriminalising Companies Act.

- The Centre has decided to increase the borrowing limits of states from 3% to 5% in FY21.

The government has announced the above five tranches for the stimulus package India. However, the pace of economic revival will determine the performance of the package.

Why stimulus package didn’t stirred market emotion

The Stimulus Package India looked very attractive by the numbers and was a ray of hope amid this outbreak. But it failed to stir market emotion. Here is why:

Announcement in Tranches

The market was expecting the stimulus package of 20 lakh crore in full swing. But, the FM made announcements in tranches. The markets rallied on Wednesday (13 May, 2020) because of the expectation of the fiscal bonanza. But the announcements didn’t indicate of fiscal bonanza. However, the announcements were in favor of MSMEs & NBFCs.

Lack of short term reforms

The Covid-19 outbreak had an adverse impact on the GDP of the country. The measures didn’t address this issue and won’t change near term growth outlook. The country is going to face a fiscal hit of Rs. 24000 crore or 0.12% of GDP in FY21 due to lockdown.

Details of borrowed funds

The FM hasn’t declared the details of funding of the economic package. She only said that the part of the funds will come from additional borrowing of 4.2 lakh crore. The details of the borrowing the funds will be made in future announcements.

Debt to GDP ratio

The debt to GDP ratio is likely to rise this year with barely any growth in the GDP. The fiscal deficit is going to rise which is a big area of concern.

The investors were expecting to provide relief in the short term but the measures don’t seem to provide quick relief. The stock market has constantly for three days dipped since the government has started making announcements regarding the package on May 13. The lockdown extension further disappointed the investors.

However, the relaxations in the Lockdown 4.0 had a positive impact on market sentiments and the stock market has shown green signals from May 18 to till date.

Finally, we hope you liked our article on Did Stimulus Package India failed to impress the stock market very helpful.

Please subscribe to our newsletter and never miss the opportunity to get the article directly to your inbox. You may be wondering how you can make a profit in this type of market situation right? Don’t worry! We have it all covered! Learn from StoxMaster- India’s Top Stock Market Training Academy and join Profit making StoxMaster’s Technical Analysis Course and get trained to trade in any market condition. Check out Free calls on telegram here. You can also learn from our Free YouTube Videos for stock market tips and advice. If you are looking forward to open new demat account to save on your brokerage than click here to open upstox demat account

0 Comments

Post a Comment